Let us use two famous investors as a proxy for our comparison. First, Warren Buffet (value) is famously a self-made investing billionaire. Second, Cathie Wood (growth) is famous for identifying disruptive growth technologies and the companies that benefit from them.

Value investors firmly plant their flags in the Buffet camp. Actual value investing is buying companies that are out of favor with the market, and they often carry operational or financial distress or both. Value investors are buying these companies cheap, but for a reason. The hope is that there will be a turnaround in the company’s fortunes, and their stock prices will increase at a better-than-market rate.

In my opinion, this is a COMMON misconception with the value category. Many think value stocks are for retirement (because they often pay dividends), and growth stocks are for pre-retirement. The “I want my money to grow, so I buy growth stocks” notion may be incorrect. What are two good recent value stock examples? Carnival Cruise Lines and Hertz Rent-a-car. If you thought either of those stocks had fallen too far, given COVID measures, you would have purchased them at their perceived discounted valuation. If they recovered, you would have enjoyed a better-than-market return if you were right.

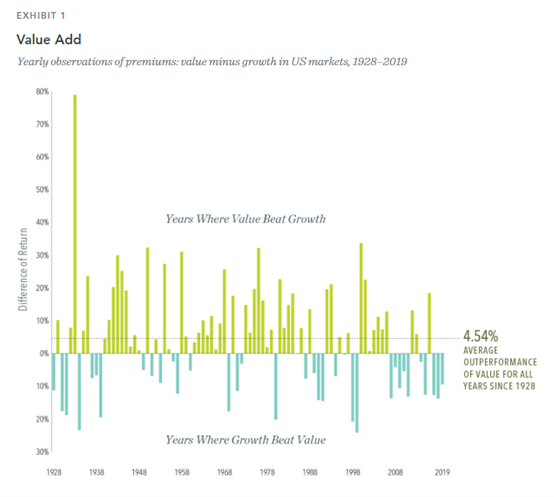

Growth investors tend to look to Cathie Wood. She invests heavily in disruptive companies. Many of these companies have yet to profit, have a massive addressable market for their product, and burn cash like crazy. The ones that do show profits often reinvest them for future growth. What is another way to commonly sniff out a growth company? Huge valuations. What is better? We are not here to answer that. You would’ve beaten value over the last 13 years if you tracked growth. Impressive. Before that, value was superior to growth in the previous 80 years! Picking one over the other assumes we know what the future will bring. We do not. Why not own both?

Source: Dimensional Fund Advisors

A well-diversified portfolio will allow you to capture the upside, whether value or growth. More importantly, your portfolio won’t suffer as much if the market favors one or the other. We talk about this in client meetings. You do not have to have all of your money in the best-performing area of the market to succeed. If you own all sizes (and you believe no one can accurately predict the future), you will always hold some of the best-performing areas of the market. This also allows us to systematically and unemotionally rebalance your portfolio by selling the winners and buying the losers to return it to its pre-determined allocation. Is that what we are all trying to do in the first place?! Buy low, sell high. We like to say, sell high, buy low.

You will also see us tilt portfolios one way or another but never vacate growth or value completely. When designing and maintaining portfolios catered to your needs, we’re not simply balancing growth vs. value, we are looking at the impact of bonds, international stock, emerging markets, etc. Said, over the long term, you’ll likely achieve the same or slightly better rate of return by taking a somewhat lower risk when you own a properly diversified portfolio.

Cathie Wood may be out of favor now, but recall recent headlines about Warren Buffet’s missteps. “For A Smart Investor, Warren Buffett Sure Slipped Up When It Came To Airlines,” Forbes, May 2020. Source: Forbes: For A Smart Investor, Warren Buffett Sure Slipped Up When It Came To Airlines

Even the world’s most significant investor will make mistakes. The market has a way of humbling even the best. We use “humbling” in the very loosest sense. I doubt Warren Buffet cares what Forbes says about his trades. If he does, he will wipe away tears with all the money he has made in his lifetime. Cathie Wood has been getting a lot of negative attention lately, again probably wiping tears with the money she has made. Both are public figures in the investing world with two different approaches to success. Sometimes, one is the GOAT, and one is the goat. Both have worn both titles.

Breaking down each approach, academics have found risk premiums or factors that makeup securities behavior. Risk premiums are based on an expected return above the risk-free rate. The risk-free rate is generally a US Government T-Bill. I invest in a stock; I hope for a return above the risk-free rate to compensate for my risk. Risk/Reward.

Academics have studied Warren Buffett’s approach to investing, which in its simplest terms, is “buy good companies cheap and hold them forever”. Buying good companies inexpensively implies a value purchase. Warren Buffett’s most successful investments typically had several things in common. He bought them when they were out of favor with the market. An example was when he purchased banks in 2009 while the market questioned whether they could stay in business after the financial crisis. Reading this, we have the benefit of hindsight, but very few investors were buying banks during the Great Recession. The banking industry fit the bill of a value investment at that time, which is a company under financial or operational distress. Identifying and buying value names here, Warren Buffett knew he was taking on more risk and was rewarded for it. I am trying to convey that true value companies carry more investment risk because we are banking (pun intended) on a turnaround.

Cathie Wood’s approach is exponential growth or disruptive growth. Growth companies traditionally reinvest their profits for a payoff, if ever. Starbucks reinvested profits into opening new stores worldwide to increase sales volume in the 90s and early aughts. It wasn’t until 2010 that Starbucks initiated its dividend. Source: Starbucks Announces Increase in Quarterly Cash Dividend.

Cathie Wood has focused on exponential growth in areas such as automation, artificial intelligence, electric vehicles, and other disruptive companies. These technologies are so new that the general population is years away from full adoption. There will be many failures as many of these companies will never achieve profitability.

Using recent history as an example of how this may pay off for investors, we would look at Netflix, Amazon, and Google. People questioned the quality and stability of video streaming when Netflix decided to taper off its DVD delivery service. There was also hesitancy to shop online on Amazon as security questions arose. Investors had severe doubts about Google generating revenue through web searches. Again, with hindsight, all three companies have a clear pathway to profitability, and early investors were rewarded handsomely. Still, for every Google, there are countless Yahoos and Netscapes. Growth investing carries a different risk where investors typically pay a premium to own shares, hoping the premium continues.

Value and growth bring their risks, but they make up the stock market together. We tend to think of growth as being technology-based, which can be valid for the most part. IBM and Oracle are some of the biggest tech names, but we wouldn’t define them as growth. Signature Bank is a regional bank, but we don’t consider it a value stock.

Warren Buffet was successful for decades because he identified a vital investing factor: the value premium. Cathie Wood was successful because of another element, momentum. Sometimes, both factors are in favor, and sometimes, one beats the other. Our job is to balance the two and ensure that if growth runs up for the next five years (for example), you don’t have an outsized portion of your portfolio allocated to that sector. The same with value, whether that be underweight or overweight. We are constantly monitoring the underlying holdings of each fund and measuring the risk factors that drive returns. Sometimes, the name of an ETF or mutual fund doesn’t accurately articulate its underlying investments, and worse, fund managers can drift over time.

We believe in actively managing your financial plan more than actively managing your investments. However, we still spend a significant amount of time ensuring that what we’re buying in client accounts maintains a proper mix of stocks, sectors, and the size of companies.

Why Living Your Wealth

If you are looking for a financial advisor(s) you can count on, consider Living Your Wealth. Our focus is solely on tech industry professionals and how to provide them with financial planning services; the Living Your Wealth team can give you reliable advice on what to do with your complex financial situation — without all the buzzwords. Start your journey with Living Your Wealth today!

Living Your Wealth and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Securities are offered through LPL Financial, Member FINRA/SIPC. Investment advice is offered through Western Wealth Management, LLC, a registered investment adviser. Living Your Wealth, LLC and Western Wealth Management, LLC are separate entities from LPL Financial.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. The opinions expressed in this material do not necessarily reflect the views of LPL Financial.

Investing involves risk including the loss of principal. Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.